“Making predictions is largely loser’s game.”

“The Folly of Certainty” which recently published (Jul 17 – 2024) on the website of the Oaktree Capital Management may broaden your horizon regarding a) investing and b) your thoughts and perspective in general.

Future – by it’s nature- is uncertain. And prediction of the future is a set projections with a lot of uncertainties -by excluding seemingly unlikely situations and various strange and bizarre possibilities-.

Mankind was always, and most likely always will be, in seek of the guidance when it comes to making a decision. The necessisty and high demand of a guide and/or prophecy never descended from the peak it is located.

The same scenario is also applicable when it comes to investing.

Which stock to choose, perfect time to enter a position, great time to buy treasury bonds, betting on the “green energy” stocks in case presidential candidate who is well known for his/her strong support on green energy wins the elections. Most of the people seek a warm, kind and gentle voice of a guide/prophet who will tell them on which path/strategy they must choose in order to achieve what they want.

As Howard Marks perfectly states on his memo, even though “the Oracle’s” predictions regarding the future or upcoming events, elections, crisis, market crashes etc. have turned out to be true, it means nothing but a “lucky coincidence.”

“Sometimes things go as people expected, and they conclude that they knew what was going to happen. And sometimes events diverge from people’s expectations, and they say they would have been right if only some unexpected event hadn’t transpired. But, in either case, the chance for unexpected- and thus for forecasting error- was present. In the latter instance, the unexpected materialized, and in the former, it didn’t. But that doesn’t say anything about the likelihood of the unexpected taking place.”1

The first thing economics professors at the college and mainstream financial analysts say when it is their turn to speak has never changed in previous decades. They define individuals who are acting as market participant as homo economicus. The one who is following the path of logos and strict his/her investing decisions in the circle of rationality in order to maximize their self-interest.

However it is not the case. Everyone, without any doubt, mostly driven by their emotions, mental and financial status and psychological state of mind especially when it comes to investing.

Hence, this results in inefficiencies and errors at forecasts and predictions of the markets’ future movements. Most analysists predicted that in case Trump get elected at 2020 elections, financial markets will effect negatively. But history proved us that stock market rose more than %30 within the first 14 months of the Trump’s presidency.

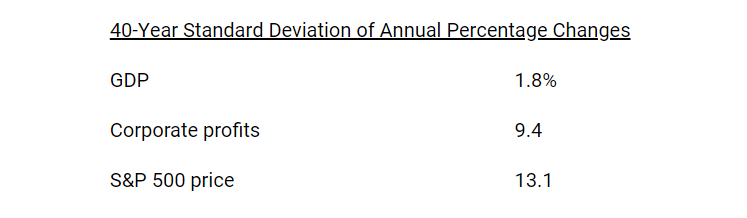

Data received from the The Folly of Certainty regarding standart deviaton of annual percentage changes of the 40 years by comparing GDP, Corporate Profits and S&P 500 Price also confirms the emotional decisions are more important and influential on individual’s decisions regarding their investment strategy.

(https://www.oaktreecapital.com/insights/memo/the-folly-of-certainty)

In a world where we are bombarding by lots of news and unnecessary informations in every miliseconds, we no longer know what to believe nor research. Every unimportant thing is accessible and easy to understand and every crucial thing is “hidden” or too complex for us to comprehend.

Indeed every information and data is accessible through internet, however the information and data we truly want to find reminds us looking for a needle in a haystack.

Hence, since people are too busy –or because they have to keep busy all the time with long working hours and smartphones that constantly “entertaining” them in their “free time”- they tend to seek for “the Oracle” for themselves.

Any random guy which they recently came across at X (previously Twitter) can be their “Crypto Guru” or Youtubers which make live streams every evening and sharing their thoughts on whether S&P 500 will go up or down and what action should their followers must take can mesmerize simple individuals who has some money in their pocket to invest. Or investors with reputation for their great successes or predictions that have turned out to be true may seem like the perfect candidate to become “the Oracle” of those individuals.

However, these approaches are fundamentally wrong and may -and definitely will- end with inevitable loss. In addition, just because someone has a great fortune does not mean that what they say or what they predict will always turn out to be true.

In the end, as mentioned at the beginning of this article, future -by it’s nature- is uncertain. And in the investing world, those uncertainties are become more vague and resulted in “real” financial losses which has huge impact on peoples’ lives.

Therefore, the most crucial thing is to create plans and strategies for every possiblity at stake rather than aiming for only one and hoping for the best. Rather than trying to predict whether S&P 500 will go up or down, trying to think “what will be my game plan if it is go up or if it is go down?” seems more decent and unapprehensive approach for non-homo economicus.

Let me gently quote the last sentence of Howard Marks’s “The Folly of Certainty” Memo as the closing words.

“Making predictions is largely loser’s game.” 2

03.08.2024 – Antalya

- The Folly of Certainty, Howard Marks (https://www.oaktreecapital.com/insights/memo/the-folly-of-certainty) ↩︎

- (The Folly of Certainty, Howard Marks : https://www.oaktreecapital.com/insights/memo/the-folly-of-certainty) ↩︎